UPDATE (01/29/2021): A class-action lawsuit has now been filed against Robinhood for restricting the sale of popular stock such as GameStop (GME), AMC, BlackBerry (BB), and more.

The lawsuit has been filed in the Southern District of New York by Brendon Nelson, a user of the app from Massachusetts. Nelson claims that Robinhood “abandoned its customers altogether,” accusing the app of “pulling securities like GME from its platform in order to slow growth and help benefit individuals and institutions who are not Robinhood customers but are Robinhood large institutional investors or potential investors.”

The scandal surrounding Robinhood and other trading apps has seen several politicians and business figures wading into the debate across the aisle, including AOC, Ted Cruz, and Elon Musk.

ORIGINAL STORY (01/28/2021): Robinhood is under fire from users who have been unable to buy or sell stock in GameStop (GME) today, with the trading app being widely criticized for restricting purchases or sales due to “recent volatility” in the market. As a result, Reddit users from r/WallStreetBets are calling for a class-action lawsuit against the app, along with bombarding its App Store and Google Play Store pages with one-star reviews.

GME stockholders call for a Robinhood ‘class-action lawsuit’

As GameStop stock continued its momentous growth when the market opened this morning, Robinhood blocked trades of GME, AMC, and others that had been targeted by Reddit users. As such, users were unable to trade their stock, thus causing downwards fluctuations in the market that otherwise may not have been there.

Robinhood announced its decision to stop trading certain stock in a blog post. “We continuously monitor the markets and make changes where necessary,” a statement from the app reads. “In light of recent volatility, we are restricting transactions for certain securities to position closing only, including $AAL, $AMC, $BB, $BBY, $CTRM, $EXPR, $GME, $KOSS, $NAKD, $NOK, $SNDL, $TR, and $TRVG. We also raised margin requirements for certain securities.”

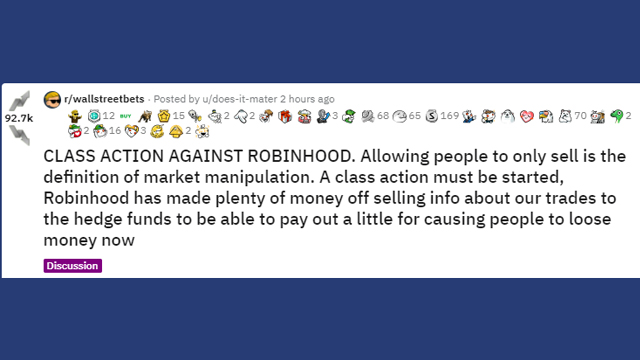

When Robinhood users found that they were unable to trade their stock on the app, many took to r/WallStreetBets and its related Discord server to accuse the app of “market manipulation.” The top-rated post on the r/WallStreetBets subreddit reads: “Robinhood has made plenty of money off selling our trades to the hedge funds to be able to pay out a little for causing people to loose [sic] money now.” It has just under 100,000 upvotes at the time of this writing.

After the restriction of trading and another volatile open to the market, GME stock declined from over $400 to $126 at the time of this writing. Retail traders took to the reviews pages of Robinhood and other trading apps to vent their frustrations, bombarding them with one-star reviews and further accusations of working in the favor of the hedge funds that were being targeted.

While r/WallStreetBets led the charge with this increase in retail trading, the community has not been without its issues as a result of the increased scrutiny placed on it. Its Discord server was banned yesterday, before its Reddit moderators were forced to make the subreddit private. Aside from the criticisms being leveled at Robinhood today, the app also struggled to deal with the explosive demand in trading, with it periodically going offline due to increased user activity.