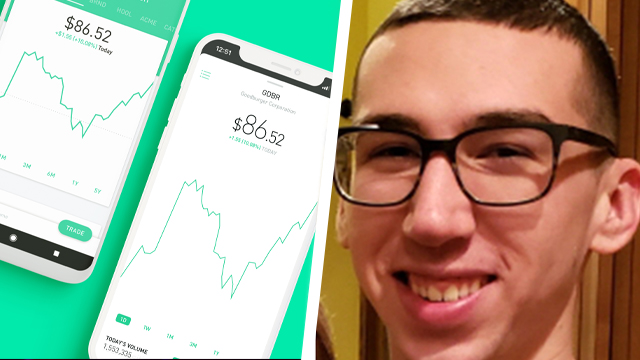

Robinhood is being sued by the family of Alexander Kearns, a 20-year-old college student who died by suicide after wrongly believing he was $730,000 in debt. Kearns’ parents are now blaming Robinhood’s lack of customer support and guidance for their son’s death, as he was not actually in debt at all — he had misread his balance on the app, which was temporarily displaying losses that did not exist.

Kearns’ $730,000 losses were displayed alongside a restriction placed on his account. After the student contacted Robinhood in an attempt to lift the restriction and investigate the reason behind the losses, he was met with an automated reply.

“Alex had written them asking for help,” Alex’s father Dan Kearns told CBS News. “And unfortunately, that’s the only way that Robinhood communicates, is through email. And their response was a canned reply, basically, ‘We’ll get back to you later.'”

Robinhood sued by Alex Kearns’ family

The day after his death, Alex received an email from Robinhood confirming that the app had lifted his trade restrictions and that he had met his margin call. This was following three emails that Alex had allegedly sent to the company without a formal response.

“How was a 20-year-old with no income able to get assigned almost a million dollars’ worth of leverage?” Kearns, who died on June 12, 2020, reportedly wrote in a note before his suicide. “The puts I bought/sold should have cancelled out, too, but I also have no clue what I was doing now in hindsight.”

The Kearns family’s attorneys Ethan Brown and Benjamin Blakeman said that Alex “would have been alive and well today” if Robinhood would have responded promptly. Following Kearns’ death, Robinhood claims it has greatly increased the size of its customer support team and hired more licensed brokers to provide customer support, while also allowing users to request call-backs from the company rather than waiting for an email.

On top of the Kearns family’s lawsuit, Robinhood faces a separate class-action lawsuit from a buyer embroiled in the GameStop (GME) controversy, after the app restricted purchases of the stock and contributed to its declining price as a result. The move was criticized by various public and political figures including AOC and Elon Musk.